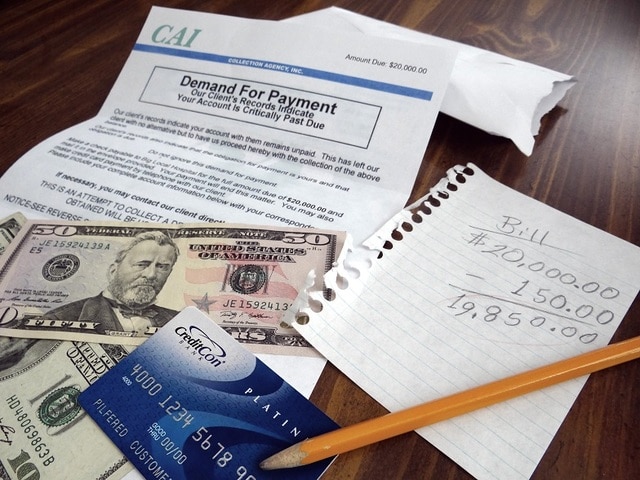

Many people that severely need money make the mistake of collaborating with companies that take cash from them rather than provide it. These scams are generally routed at people who currently have poor credit ratings. Even more, individuals remain in monetary difficulty than ever before, and many crooks are making the most of this situation. Those who are filing for credit rating counseling or bankruptcy are at a high threat for these sorts of scams. Right here I will certainly reveal you typical scams and also what you can do to prevent them.

Money In Advance Rip-offs

If you are in a scenario where you need to submit bankruptcy or look for credit score counseling, your life is most likely currently hard enough as it is. The last point you desire is some scam artist taking even more of your money. However, a significant market exists for these kinds of rip-offs. The most typical method utilized by debt consolidation solutions is to make a deal to car loan a customer cash regardless of their credit rating. They will certainly ask that the customer pays 3 months in advance prior to they are able to lend them money. The firm after that takes the payments and also declines to lend the customer cash, stealing from them.

Many of the consumers never hear from the firm once more. Most of these businesses make themselves show up reputable by acquiring marketing space in the neighborhood phonebook, a location that most individuals depend find their details. As more individuals deal with debt, these rip-offs will certainly remain to enhance.

You ought to stay clear of any kind of lender which asks you to pay money upfront for the car loan. This is usually the initial sign that a solution is likely a scam. There is no reason you need to need to pay a cost in advance. Any type of loan provider which asks you to pay prior to you getting the money is likely to con artists. You should only need to pay the money back after you have actually been offered money, not before. Many of these solutions will additionally try to obtain you to send a cord transfer.

Wire transfer services like Western Union are not safeguarded, as well as there is no choice readily available if something fails. The deals can’t be traced, and you ought to avoid any services which ask you to wire cash to them. If you really feel the demand to obtain cash, you need to use a solution that is recommended by a close friend or member of your family. This is much better than calling an arbitrary service that you have actually never ever heard of.

A Word On The Side Of Care

It is necessary to be cautious when looking for loans, especially those which are unsecured. The first thing you ought to realize is that there is no such thing as funding that is guaranteed. You must watch out for lending institutions that guarantee that you will be accepted without bothering to check your credit report.

It is an unfortunate fact of life that lots of people make an occupation out of taking money from others. Much of this fraudulence is committed by teams that are highly organized. Getting scammed in a circumstance where you are currently on the verge of personal bankruptcy can be sufficient to push any person over the edge. Individuals have a tendency to make the most blunders when they are desperate. It is very important to analyze the circumstance and study the loan provider meticulously. Anytime you are asked to pay cash in advance this commonly implies that it is a fraud, as well as will not end well if you succumb to it.

The most essential thing you can do prior to selecting a lending institution is to do study. Learn the length of time a firm has actually remained in existence. If they don’t have a well-established history, this most likely method they are a fly-by-night operation, as well as you will wish to prevent it.

Written by Amy M. Cardenas

Like Us On Facebook